Opponents of Proposition CC are saying the ballot measure would “take away” a property tax exemption for seniors and veterans when, in fact, it would not.

Prop CC allows Colorado’s state government to keep already-collected taxes that otherwise would have been refunded under TABOR–and to spend the money on schools and roads.

9News and ColoradoPolitics reported that Prop CC would not affect the Homestead Property Tax Exemption, which significantly reduces property taxes for seniors and disabled veterans.

Asked by a viewer, “Does Prop CC affect the Homestead Property Tax Exemption,” 9News anchor Kyle Clark replied succinctly on air, “No, it does not.”

Clark’s viewers may have been confused by widespread misinformation about Prop CC that’s being spread by its opponents.

The Arapahoe County Republican Party posted on its Facebook page that Prop CC would “take away Seniors’/Veterans’ property tax exemption.”

A message asking the Arapahoe GOP to remove the inaccurate information was not returned.

The official website of the “No on CC” campaign states that Prop CC “would hurt seniors and veterans” by putting their property tax exemptions “at risk.”

“Proposition CC would take that refund money away,” falsely states the No on CC campaign.

ColoradoPolitics reporter Marianne Goodland cleared up misinformation from the “No on CC” campaign in a post Saturday that referenced No on CC’s false statements.

Goodland reported:

A rumor making the rounds (including here) is that Proposition CC will eliminate long-cherished property tax exemptions for seniors and disabled military veterans, if it passes on the Nov. 5 ballot.

Not so, say experts such as state Treasurer Dave Young and the state economists who wrote a fiscal analysis of the measure.

Among the reasons: Proposition CC is a statutory measure that seeks to change state law, not the state Constitution. However, the property tax exemptions for seniors and disabled veterans came about from voter approval of not one, but two constitutional measures.

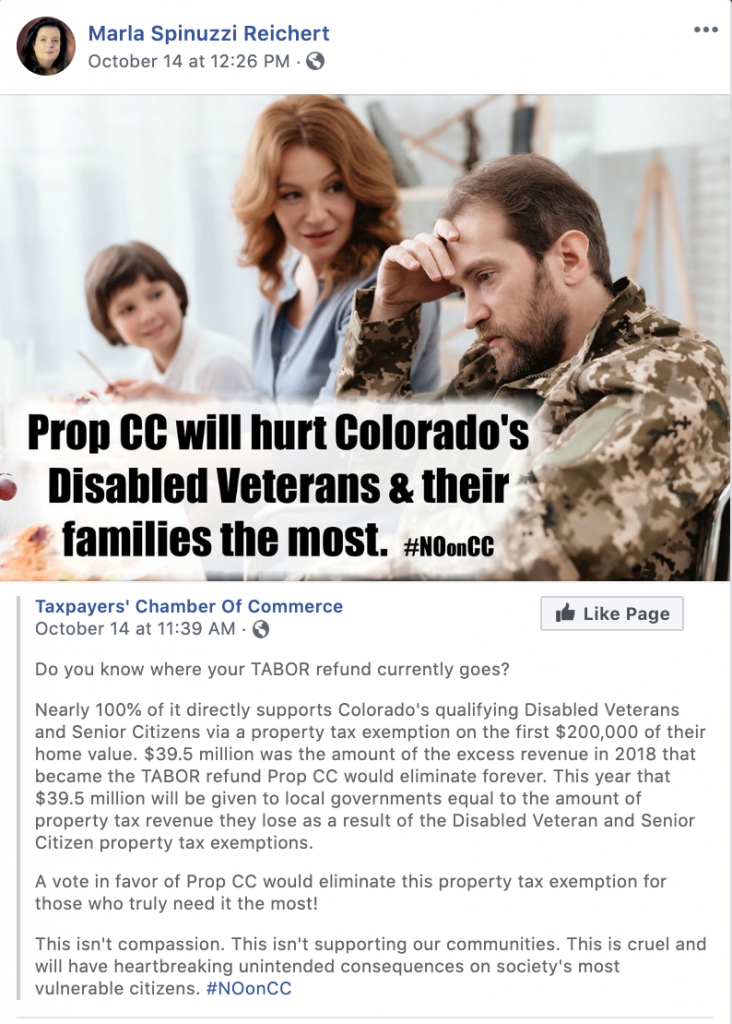

Others who’ve been spreading misinformation about Prop CC include Pueblo County Republican Chair Marla Spinuzzi Reichert.

Riechert shared a Facebook post stating, “Prop CC will hurt Colorado’s Disabled Veterans and their families the most.”

Reached by phone, Reichert said, “It puts the exemption at risk, and that’s why I shared it.”

Reichert’s inaccurate information came from the Taxpayer Chamber of Commerce, an advocacy group, that should not be confused with any real chamber of commerce.

In recent weeks, the No on CC campaign, as well as the Arapahoe County Republican Party and a Republican lawmaker also falsely stated that Prop CC would halt all tax refunds, including personal tax refunds for those who overpaid on their state taxes during the year.

During the past 14 years, taxpayers received just one refund under TABOR rules, in 2015. The checks ranged from $13 to $41. This year, the refund is estimated to be around $60, and the state wants this money for roads and schools.

UPDATE: This post was updated with a quote from Reichert.