Last week, 9News anchor Kyle Clark answered questions from viewers about his station’s story about Proposition CC, which would allow Colorado to keep already-collected taxes that otherwise would have been refunded under TABOR.

9News viewers wanted to know if it were true that, under Prop CC, the state of Colorado would not keep the money you get when you overpay state taxes.

“Absolutely correct,” was Clark’s response, due to the fact that Colorado would only keep TABOR refunds. You still get your personal refund, if one is owed to you.

Clark said on air that he appreciated viewers who ask for information that’s unclear or incomplete in the station’s reporting.

In this case, however, it appears that the source of confusion about Prop CC refunds could well be misinformation from the opponents of the ballot measure.

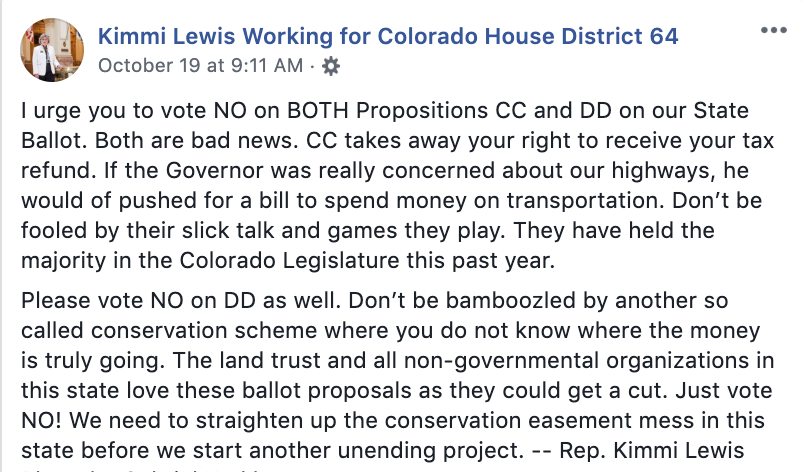

For example, State Rep. Kimmi Lewis, a Republican, wrote on her Facebook page that Prop CC “takes away your right to receive your tax refund.” She made no mention of TABOR at all, much less any effort to distinguish between TABOR refunds and personal tax refunds.

On its Facebook page, the Arapahoe County Republican Party weighed in with its own version of the same misinformation, stating, “If the government keeps our refund $$$, that IS a tax increase.”

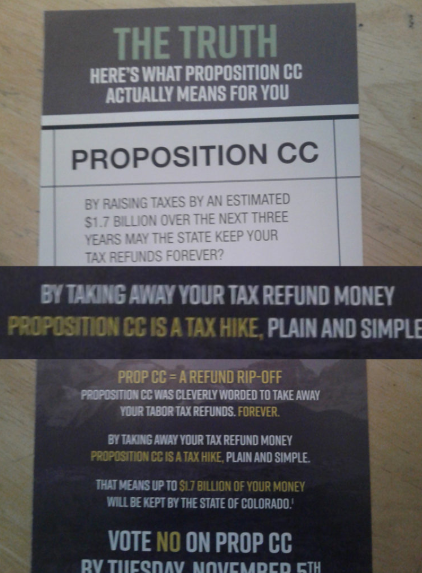

Anti-Prop CC advertisements are taking the same approach.

As first reported by ColoradoPols yesterday, opponents of Prop CC are mailing advertisements warning that the measure will let the state “keep your tax refunds forever.”

That’s seriously misleading.

Over the past 14 years, taxpayers received exactly one refund under TABOR rules, in 2015. The checks ranged from $13 to $41. This year, the refund is estimated to be around $60, and the state wants this money for roads and schools.